Master the BRRRR Method: Your Path to Smart Investment in Northern Virginia

Unlock the potential of real estate investing with the BRRRR method. Discover how to turn challenges into opportunities and build wealth in Northern Virginia.

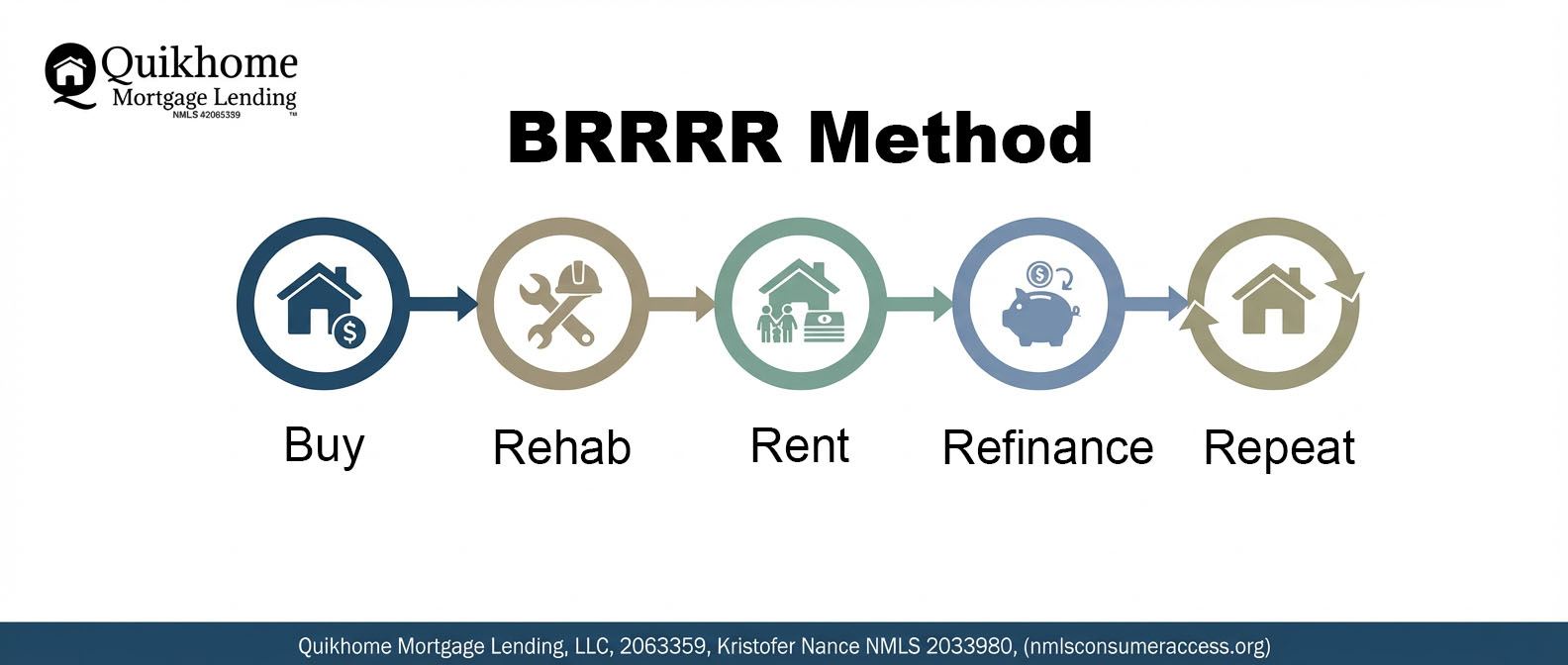

Investing in real estate can be a rewarding journey, especially for those looking to build wealth over time. One method that has gained popularity among investors is the BRRRR method. This strategy stands for Buy, Rehab, Rent, Refinance, and Repeat. It offers a way to maximize your investment and create a sustainable source of passive income. If you are considering this method in Northern Virginia, understanding how it works and the local market dynamics can set you on the right path.

To start, let’s break down the BRRRR process step by step.

1. **Buy**: The first step is to purchase a property. Look for homes that are undervalued or in need of significant repairs. In Northern Virginia, neighborhoods with upcoming developments or revitalization projects can be excellent targets. Properties that have been on the market for a while or are foreclosures can also provide good opportunities. When scouting for your investment, consider the property’s potential for appreciation, its location, and the type of tenants you may attract.

2. **Rehab**: Once you have acquired a property, the next step is to renovate it. Focus on upgrades that will provide the best return on investment. This usually includes cosmetic improvements such as kitchen and bathroom renovations, new flooring, and fresh paint. In Northern Virginia, where many homes may have a classic charm, modernizing while respecting the home’s character can appeal to potential renters. Ensure that you stick to a budget and timeline to keep costs manageable.

3. **Rent**: After the renovations are complete, it’s time to find tenants. Understanding the rental market in Northern Virginia is crucial. Research average rental prices in different neighborhoods to set a competitive rate that attracts tenants while still providing you with positive cash flow. Consider marketing your property on popular rental websites and social media platforms to reach a broader audience. Quality tenants are key, so take the time to screen applicants thoroughly.

4. **Refinance**: Once the property is rented and generating income, you can consider refinancing. This step allows you to pull out equity from your investment. In the context of Northern Virginia’s real estate market, refinancing can free up capital to reinvest in another property or to fund further renovations on your current property. It’s essential to consult with a mortgage professional to understand your options and find the best refinancing terms for your situation.

5. **Repeat**: The final step is to repeat the process. Use the equity you’ve pulled out from the previous property to purchase another one. This can create a snowball effect, allowing you to build a portfolio of rental properties over time. The more properties you acquire, the more rental income you generate, which can lead to financial freedom and increased wealth.

As you navigate the BRRRR strategy, there are several nuances to keep in mind. First, the real estate market can fluctuate, and Northern Virginia is no exception. It’s important to stay informed about local market trends, including average home prices and rental rates. Partnering with a local real estate agent who understands the Northern Virginia market can provide valuable insights.

Second, managing properties can be time-consuming. As you grow your portfolio, consider whether property management services are right for you. Professional management can help alleviate the stress of dealing with tenants and maintenance issues, allowing you to focus on acquiring new properties.

Additionally, understanding the financial aspects of your investments is vital. Keep a detailed record of all expenses related to each property, including mortgage payments, taxes, insurance, and maintenance costs. This will not only help you track your profitability but will also be essential when it comes time to file your taxes or apply for further financing.

Networking with other real estate investors can also be beneficial. Local investor meetups or online forums can provide additional resources and support as you embark on your investment journey. Learning from the experiences of others can help you avoid common pitfalls and can lead to valuable partnerships.

While the BRRRR method is an attractive investment strategy, it requires careful planning and execution. Setting clear goals for your investments can help guide your decisions. Whether you’re looking to build wealth, create passive income, or achieve financial independence, having a roadmap can keep you focused and motivated.

As you embark on this journey, remember that you don’t have to do it alone. If you have specific questions or need assistance, I encourage you to reach out. Understanding your individual needs and circumstances is essential to navigating the BRRRR method successfully in Northern Virginia. Let’s discuss how you can achieve your investment goals.