Recent Articles

Housing Affordability in 2026: Why Rates Are not the Only Factor

Learn about home affordability factors with examples nationwide.

Refinancing Isn’t Just About the Rate — It’s About Your Options

Learn what options refinancing makes available to you.

BIG NEWS: Mortgage Rates Are at Their Lowest Level in Years—What That Means for You

Find out what this rate drop means to you for buying a new home.

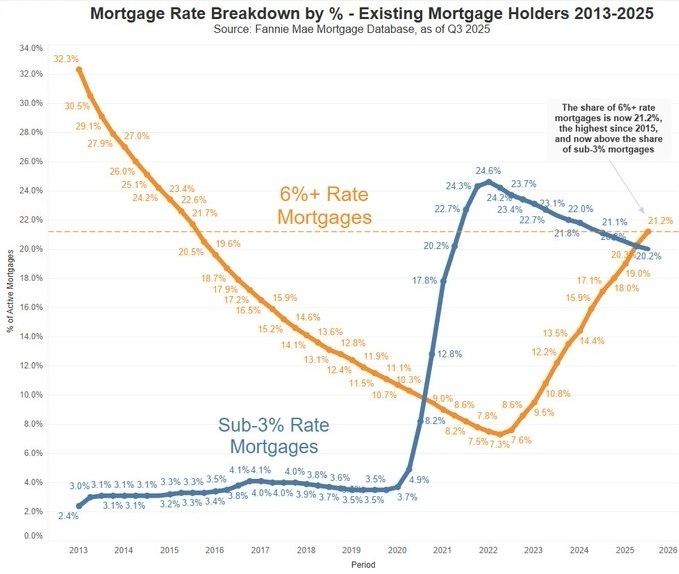

Lock-in Effect: Something big just happened in the U.S. Housing Market

Find out what the experts are anticipating for 2026 housing

Holiday Week Catch-Up: Mortgage Rates Hover Near 2-Month Lows

A holiday-week catch-up: light trading kept markets mostly sideways, but the average 30-year fixed edged to near two-month lows as bonds got a small lift from Europe and pending home sales improved.

Inflation Cools in November — What It Means for Mortgage Rates

Inflation slowed in November after peaking earlier this fall. Here’s what that means for mortgage rates and what homebuyers should watch next.

Master the BRRRR Method: Your Path to Smart Investment in Northern Virginia

Unlock the potential of real estate investing with the BRRRR method. Discover how to turn challenges into opportunities and build wealth in Northern Virginia.

Fed Cuts Again, But Dot Plot Steers Mortgage Rate Outlook

The Fed cut rates by 0.25% and ended quantitative tightening, but the real story for the average 30-year fixed is in the dot plot and Powell’s comments. Here’s what that means for mortgage rates and homebuyers.

Mastering Fix and Flip Loans: Your Path to Profitable Home Investments

Unlock your potential as a home investor. Discover how fix and flip loans can easily finance your renovations, enabling quick profits and smooth sales.